Property Taxes

California

California property taxes can be quite complex. Buyers and sellers in the state often find it confusing to determine who owes what and when. The tax assessor’s office operates 4-6 months in advance to handle real estate transactions, which means there is a delay in updating property records. We address the most common questions to clarify property tax responsibilities for both buyers and sellers.

Do I still have to pay property taxes if I’m selling my home?

In California, sellers are responsible for paying property taxes up until the close of escrow, even if the closing date is close to the installment due date. The property tax will be prorated at the closing.

When are property taxes due?

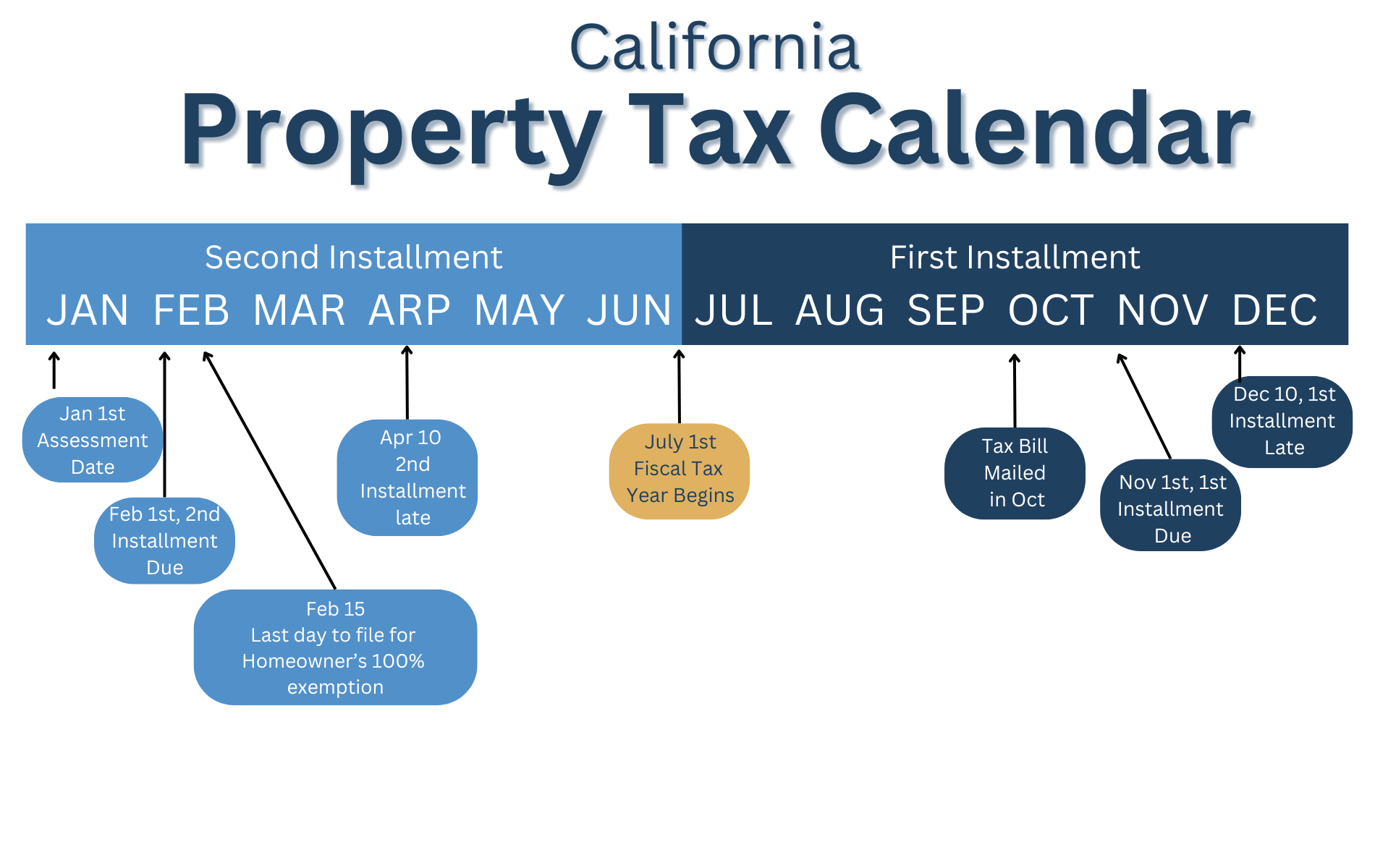

California property taxes are paid in two installments:

- The first installment is due on November 1 and is considered late if not paid by December 10.

- The second installment is due on February 1 and is considered late if not paid by April 10.

Who is responsible for the property taxes?

Under California law, the individual who owns the property on January 1st of the current year is responsible for the property taxes until the sale of the property and escrow closes. After the escrow is completed, the new owner will be responsible for the property taxes for that year on a prorated basis. The graphic below illustrates this process in detail.

Tax Calendar Notes

- Penalties for delinquency are 10% on the date of delinquency, plus $10.00 for the delinquent 2nd installment. Thereafter, 1.5% per month of the original tax amount

until paid.

- Property may be sold at public auction after 5 years of delinquency.

Tax Impound Reserve Schedule Notes

- The impound Reserve Schedule shows the “minimum” months required by the lender to collect a sufficient amount to pay the next tax installment. The listed months

are approximate and to be used as an example only. Please refer to your Lender for specific requirements and conditions on impounds on your loan(s).

When do I need to pay my First Property Tax Bill?

When you purchase a home, you will pay property taxes at closing based on the seller’s tax amount, as the property tax records may not immediately reflect the new ownership. It typically takes the assessor’s office 4-6 months to update the property tax records to show the new owner’s name and adjust the taxes based on the purchase price. Once the county updates the records, they will send you a supplemental tax bill to cover the difference between the taxes paid through escrow and the new property tax amount.

Confusion often arises during this period before the tax records are updated. During this time, the California property tax bill may be sent to the previous owner or forwarded to their new address, which means you might not receive it. Despite not receiving a bill, you are still responsible for paying the property taxes. Make sure to visit the county tax assessor’s website to pay the taxes. You can find the Alameda County Tax Assessor’s office here, the Contra Costa County Tax Assessor’s office here or the San Francisco County Tax Assessor’s office here.

Be aware that your first-year property tax bill will not reflect the new purchase price. Instead, it will be based on the price the seller originally paid for the home, and it will be prorated based on your closing date. The following year, after the county updates the tax roll with the new purchase price, you will receive a supplemental tax bill to cover the difference.

For more information on California Property Taxes contact Wayne & Joseph

They understand you might have additional questions about escrow, taxes, and the allocation of responsibilities between buyers and sellers. Feel free to contact Wayne & Joseph with any inquiries or comments. Their here to guide you through the process and make it as smooth as possible.